Disaster Recovery: Expect the worst, plan for the best

Friday, July 5th, 2019

Gisela VilaBack to blogs >

Successful businesses focus on delivering value to their customers, suppliers, employees, and investors, while also meeting regulatory requirements in certain high-stakes industries. This includes the ability to continue operating even under the worst circumstances and conditions. These include, fire, floods, snow, roadworks, storm surges, computer viruses, computer/data loss and loss of an important supplier/customer

Is your business ready for an unplanned event?

Unplanned events can have a devastating effect on small and medium businesses, and because businesses often don't have the resources to be able to respond quickly when a disaster happens, it is important for leaders to think through what would happen if a power outage or any system failure occurs.

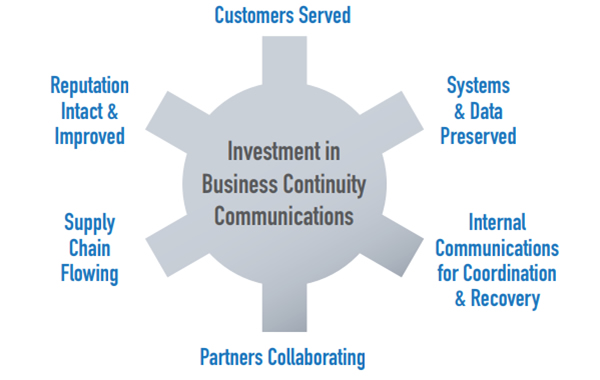

All companies should have a Disaster Recovery Plan to keep the company up and running through interruptions of any type. Business Continuity Plan includes risk mitigation for all areas of your business that could be impacted during an unplanned event. The communications aspect of your plan can ensure your risk mitigation strategy is executed successfully and cohesively.

What is the average impact of a system shutdown?

According to a University of Texas study, even a brief system shutdown can have significant effects on your business, and be far harder to recover from.

- 0.5% of market share every 8 hours

- 3 years to recover 0.5% of market share

- One year of consequences for every 6 hours of downtime

- Within the first 5 days after a disaster, a company can lose 0.5% of revenue

Why develop a Business Continuity Plan?

The following are some of the most important reasons for developing a Disaster Recovery Plan:

- Protect employees

- Maintain cash flow

- Moral and legal obligations

- Maintain customer relations and client base

- Defend legal action from shareholders

The worst-case scenario for your business would be losing hard fought for customers, impacting your customer's business or partners. At the same time, you are at risk of losing valuable data such as contact lists, directories, historical information, calendars, schedules and more.

By planning ahead, making sure you have regular back-ups and a path to restoring them, or alternate systems, off-site or in the cloud for functions that must not be interrupted, you can ensure that a disaster doesn't turn into a tragedy, and that your business continues, no matter what.

How are insurers involved in your Disaster Recovery Plan?

While the server your business's critical information is stored on may be covered by your insurance policy, everything it contains within its drives is not. Not all insurers will cover the expenses incurred through data loss either, although they may cover the costs of the physical hardware. Many insurers require you to have a DR Plan as part of your coverage.

When a disaster occurs, how will your business reach out to your customers?

Your company can struggle in communicating during or immediately after a disaster. To overcome this obstacle, a business continuity communication plan should include multiple means of reaching customers and stakeholders with a variety of communications options such as text messaging, email, social media channels, etc. Implementing a Business Continuity Plan that involves cloud-based real time communications, like Temovi, have proven to make immediate and significant impacts.

More and more businesses are moving to communications as a service (CaaS) not only for business continuity, even though the cloud makes business continuity much easier and intuitive for end users. Temovi real-time communications, including voice, messaging and collaboration, compared to traditional premise-based communication systems approaches are less expensive, scalable, available everywhere, clearly defined and flexible.